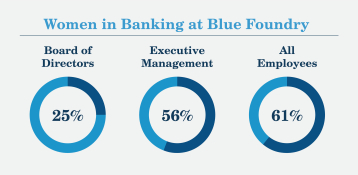

The Company’s diversity is demonstrated throughout the organization, including by the members of the Executive Management team. Of our nine executives, fivefour are women, one of whom is a member of an underrepresented minority group. Overall, Blue Foundry Bank’s staff is 61%64% female and 39%36% male. In addition,keeping with the Board’s commitment to further diversify, the Board of Directorsrecently appointed Elizabeth Jobes resulting in a board that currently includes twothree women, and theone of whom is a member of an underrepresented minority group. The Board has made it a continuing priority to further expand its diversity.

Further information related to Blue Foundry Bank’s support of its communities through volunteerism and philanthropic activities can be found in the ‘In the News’ section of Blue Foundry Bank’s website.

All directors and do not, incorporate the contents of our websites by reference into this proxy statement or the accompanying materials. DELINQUENT SECTION 16(A) REPORTS

Our executive officers and directors and beneficial owners of greater than 10% of the outstanding shares of common stock are required to file reports with the Securities and Exchange Commission disclosing beneficial ownership and changes in beneficial ownership of our common stock. Securities and Exchange Commission rules require disclosure if an executive officer, director or 10% beneficial owner fails to file these reports onas a timely basis. Based solely on its review of copies of the reports the Company has received and written representations provided to it from the individuals required to file Section 16(a) reports, the Company believes that each individual who, at any time during the fiscal year ended December 31, 2021, served as an executive officer or director of the Company has complied with applicable reporting requirements for transactions in Company common stock during the fiscal year ended December 31, 2021, except for Mirella Lang and Jason Goldberg who due to administrative oversights failed to timely file one Form 4 and one Form 3, respectively, to report one transaction in the Company’s stock. We believe that no other executive officer, director or 10% beneficial owner of our shares of common stock failed to file ownership reports on a timely basis.group (17 persons)

CODE OF ETHICS FOR SENIOR OFFICERS

Blue Foundry Bancorp has adopted a Code of Ethics for Senior Officers that applies to Blue Foundry Bancorp’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Ethics for Senior Officers is available on our website at www.bluefoundrybank.com andcan be accessed by clicking “Investor Relations” and then “Governance—Governance Documents.” Amendments to and waivers from the Code of Ethics for Senior Officers will also be disclosed on our website.

ATTENDANCE AT ANNUAL MEETINGS OF STOCKHOLDERS

Blue Foundry Bancorp does not have a written policy regarding director attendance at annual meetings of stockholders, although directors are expected to attend these meetings absent unavoidable scheduling conflicts. We anticipate that all of our directors will attend the 2022 Annual Meeting of Stockholders, which is our first annual meeting of stockholders.

| | | | | | | | | | Blue Foundry Bancorp | 2022 Proxy Statement

| | 15

| | | | | | | 4.16 | % |

| * |

| | | Proposal I: Election of Directors | | Less than 1%. |

| (1) | COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Any stockholder who wishes to contact our Board of Directors or an individual director may do so by writing to: Blue Foundry Bancorp, 19 Park Avenue, Rutherford, New Jersey 07070, Attention: Board of Directors. The letter should indicate that the sender is a stockholder and, if shares are not held of record, should include appropriate evidence of stock ownership. Communications are reviewed by the Corporate Secretary and are then distributed to the Board of Directors or the individual director, as appropriate, depending on the facts and circumstances outlined in the communications received. The Corporate Secretary may attempt to handle an inquiry directly (for example, where it is a request for information about Blue Foundry Bancorp or it is a stock-related matter). The Corporate Secretary has the authority not to forward a communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. At each Board of Directors meeting, the Corporate Secretary shall present a summary of all relevant communications received since the last meeting that were not forwarded and make those communications available to the Directors on request.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The business of Blue Foundry Bancorp is conducted at regular and special meetings of the Board of Directors and its committees. In addition, the “independent” members of the Board of Directors (as defined in the listing standards of the NASDAQ Stock Market) meet in executive sessions. The standing committees of the Board of Directors of Blue Foundry Bancorp are the Audit Committee, Compensation Committee, the Nominating and Corporate Governance Committee, and the Enterprise Risk Management Committee.

The Board of Directors of Blue Foundry Bancorp held eightregular meetings and twospecial meetings during the year ended December 31, 2021. The Board of Directors of Blue Foundry Bank held twelve regular meetings during the year ended December 31, 2021. No member of the Board of Directors or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees on which he or she served (during the periods that he or she served).

Audit Committee. The Audit Committee consists of Directors Ely, Grimbilas, Kinzler and Lang. Mr. Ely serves as Chair of the Audit Committee. Each member of the Audit Committee is “independent” as defined in our Nominating and Corporate Governance Committee Charter. The Board of Directors has determined that Mr. Ely qualifies as an “audit committee financial expert” as that term is used in the rules and regulations of the Securities and Exchange Commission.

Our Board of Directors has adopted a written charter for the Audit Committee, which is available on our website at www.bluefoundrybank.com and can be accessed by clicking “Investor Relations” and then “Governance—Governance Documents.” As more fully described in the Audit Committee Charter, the Audit Committee reviews the financial records and affairs of Blue Foundry Bancorp and monitors adherence in accounting and financial reporting to accounting principles generally accepted in the United States of America. The Audit Committee met 9 times during the year ended December 31, 2021.

Compensation Committee. The Compensation Committee consists of Directors Grimbilas, Ely, Goldstein, Letsche and Shaw. Mr. Goldstein serves as Chair of the Compensation Committee. No member of the Compensation Committee is a current or former officer or employee of Blue Foundry Bancorp or Blue Foundry Bank. The Compensation Committee met 4 times during the year ended December 31, 2021.

With regard to compensation matters, the Compensation Committee’s primary purposes are to discharge the Board’s responsibilities relating to the compensation of the Chief Executive Officer and other executive officers, to oversee Blue Foundry Bancorp’s compensation and incentive plans, policies and programs, and to oversee Blue Foundry Bancorp’s management development and succession plans for executive officers. Blue Foundry Bancorp’s Chief Executive Officer will not be present during any committee deliberations or voting with respect to his compensation. The Compensation Committee may form and delegate authority and duties to subcommittees as it deems appropriate.

During the year ended December 31, 2021, the Compensation Committee utilized the assistance of Pearl Meyer, compensation consultant, to review Board and executive compensation.

The Compensation Committee operates under a written charter which is available on our website at www.bluefoundrybank.com and can be accessed by clicking “Investor Relations” and then “Governance—Governance Documents.” This charter sets forth the responsibilities of the Compensation Committee and reflects the Compensation Committee’s commitment to create a compensation structure that encourages the achievement of long-range objectives and builds long-term value for our stockholders.

| | | | | | | | 16 | | Blue Foundry Bancorp | 2022 Proxy Statement

| | |

| | | | | | | | Proposal I: Election of Directors | |

The Compensation Committee considers a number of factors in its decisions regarding executive compensation, including, but not limited to, the level of responsibility and performance of the individual executive officers, the overall performance of Blue Foundry Bancorp and a peer group analysis of other financial institutions. In order to identify the appropriate compensation level necessary to attract and retain the talent to build the institution, we consulted with our compensation consultant in developing our peer group. Our peer group is comprised of institutions of similar complexity, within the tri-state geographic area, having approximately $400 million in equity and an asset size of approximately $3 billion.

Our executive compensation program is designed to:

Attract and retain talented employees in leadership positions by recognizing the importance of these individuals to Blue Foundry Bancorp.

Support our strategic performance objectives. Our goal is to provide executive officers with a total compensation package competitive with the market and industry in which we operate, and to promote the long-term goals and performance of Blue Foundry Bancorp. With this in mind, we implemented a new, formal annual incentive plan in 2020 that pays cash awards to the executive officers based on certain performance metrics without encouraging them to take unnecessary risks. By doing this, we align the interests of management with those of our stockholders.

For 2021, the salary increases for executive officers were very modest with more compensation moving under the annual incentive plan. As previously mentioned, the Committee engaged Pearl Meyer in 2021 to review executive compensation.

If stockholders approve our 2022 Equity Incentive Plan, we intend to incorporate long term equity awards into the overall compensation package of our executive officers. We believe long term equity awards further align the interest of management with those of our stockholders.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee consists of Directors Grimbilas, Goldstein, Letsche and Shaw with Mr. Shaw serving as Chair. The Nominating and Corporate Governance Committee met twice during the year ended December 31, 2021.

The Nominating and Corporate Governance Committee operates under a written charter which is available on our website at www.bluefoundrybank.com and can be accessed by clicking “Investor Relations” and then “Governance—Governance Documents.”

As more fully described in its charter, the Nominating and Corporate Governance Committee assists the Board of Directors in identifying qualified individuals to serve as Board members, in determining the composition of the Board of Directors and its committees, in developing, recommending and overseeing a process to assess Board effectiveness and in developing and recommending the Company’s corporate governance guidelines. The Nominating and Corporate Governance Committee also considers and recommends the nominees for director to stand for election at the Company’s annual meeting of stockholders.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE PROCEDURES

It is the policy of the Nominating and Corporate Governance Committee of the Board of Directors to consider director candidates recommended by stockholders who appear to be qualified to serve on the Board of Directors. The Nominating and Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating and Corporate Governance Committee does not perceive a need to increase the size of the Board of Directors. To avoid the unnecessary use of the Nominating and Corporate Governance Committee’s resources, the Nominating and Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Rule Diversity Considerations. The Board of Directors does not have a formal policy or specific guidelines regarding diversity among board members. However, the Board of Directors seeks members who represent a mix of backgrounds that will reflect the diversity of our stockholders, employees, and customers, and experiences that will enhance the quality of the Board of Directors’ deliberations and decisions. As the holding company for a community-oriented bank, the Board of Directors also seeks directors who can continue to strengthen Blue Foundry Bank’s position in its community and can assist Blue Foundry Bank with business development through business and other community contacts. The Board of Directors is committed to continuing to diversify the composition of the Board. | | | | | | | | | | Blue Foundry Bancorp | 2022 Proxy Statement

| | 17

|

| | | Proposal I: Election of Directors | | |

Process for Identifying and Evaluating Nominees; Director Qualifications. The Board of Directors considers the following criteria in evaluating and selecting candidates for nomination:

| • | | Contribution to Board—Blue Foundry Bancorp endeavors to maintain a Board of Directors that possesses a wide range of abilities. Thus, the Board of Directors will assess the extent to which the candidate would contribute to the range of talent, skill and expertise appropriate for the Board of Directors. The Board of Directors will also take into consideration the number of public company boards of directors, other than Blue Foundry Bancorp’s, and committees thereof, on which the candidate serves. The Board of Directors will consider carefully the time commitments of any candidate who would concurrently serve on the boards of directors of more than two public companies other than Blue Foundry Bancorp.

|

| • | | Experience—Blue Foundry Bancorp is the holding company of Blue Foundry Bank, an insured depository institution. Because of the complex and heavily regulated nature of Blue Foundry Bancorp’s business, the Board of Directors will consider a candidate’s relevant financial, regulatory and business experience and skills, including the candidate’s knowledge of the banking and financial services industries, familiarity with the operations of public companies and ability to read and understand fundamental financial statements, as well as real estate and legal experience.

|

| • | | Familiarity with and Participation in Local Community—Blue Foundry Bancorp is a community-oriented organization that serves the needs of local consumers and businesses. In connection with the local character of Blue Foundry Bancorp’s business, the Board of Directors will consider a candidate’s familiarity with Blue Foundry Bancorp’s market area (or a portion thereof), including without limitation the candidate’s contacts with and knowledge of local businesses operating in Blue Foundry Bancorp’s market area, knowledge of the local real estate markets and real estate professionals, experience with local governments and agencies and political activities, and participation in local business, civic, charitable or religious organizations.

|

| • | | Integrity—Due to the nature of the financial services provided by Blue Foundry Bancorp and its subsidiary, Blue Foundry Bancorp is in a special position of trust with respect to its customers. Accordingly, the integrity of the Board of Directors is of utmost importance to developing and maintaining customer relationships. In connection with upholding that trust, the Board of Directors will consider a candidate’s personal and professional integrity, honesty and reputation, including, without limitation, whether a candidate or any entity controlled by the candidate is or has in the past been subject to any regulatory orders, involved in any regulatory or legal action, or been accused or convicted of a violation of law, even if such issue would not result in disqualification for service under Blue Foundry Bancorp’s Bylaws.

|

| • | | Stockholder Interests and Dedication—A basic responsibility of directors is the exercise of their business judgment to act in what they reasonably believe to be in the best long-term interests of Blue Foundry Bancorp and its stockholders. In connection with such obligation, the Board of Directors will consider a candidate’s ability to represent the best long-term interests of Blue Foundry Bancorp and its stockholders, including past service with Blue Foundry Bancorp or Blue Foundry Bank and contributions to their operations, the candidate’s experience or involvement with other local financial services companies, the potential for conflicts of interests with the candidate’s other pursuits, and the candidate’s ability to devote sufficient time and energy to diligently perform his or her duties, including the candidate’s ability to personally attend board and committee meetings.

|

| • | | Independence—The Board of Directors will consider the absence or presence of material relationships between a candidate and Blue Foundry Bancorp (including those set forth in applicable listing standards) that might impact objectivity and independence of thought and judgment. In addition, the Board of Directors will consider the candidate’s ability to serve on any Board committees that are subject to additional regulatory requirements (e.g. Securities and Exchange Commission regulations and applicable listing standards). If Blue Foundry Bancorp should adopt independence standards other than those set forth in the NASDAQ Stock Market listing standards, the Board of Directors will consider the candidate’s potential independence under such other standards.

|

| • | | Gender and Ethnic Diversity—Blue Foundry Bancorp understands the importance and value of diversity, including gender, ethnicity, and other status, on a board of directors and will consider highly qualified candidates and their demographic backgrounds, including women and individuals from minority groups, to include in the pool from which candidates are chosen. The Board of Directors is committed to continuing to diversify the composition of the Board.

|

| • | | Additional Factors—The Board of Directors will also consider any other factors it deems relevant to a candidate’s nomination, including the extent to which the candidate helps the Board of Directors reflect the diversity of Blue Foundry Bancorp’s stockholders, employees, customers and communities. The Board of Directors also may consider the current composition and size of the Board of Directors, the balance of management and independent directors, and the need for audit committee expertise.

|

| | | | | | | | 18 | | Blue Foundry Bancorp | 2022 Proxy Statement

| | |

| | | | | | | | Proposal I: Election of Directors | |

The Board of Directors identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service, including the current members’ board and committee meeting attendance and performance, length of board service, experience and contributions, and independence. Current members of the Board of Directors with skills and experience that are relevant to Blue Foundry Bancorp’s business and who are willing to continue in service are considered for re-nomination,13d-3 balancing the value of continuity of service by existing members of the Board of Directors with that of obtaining a new perspective. If there is a vacancy on the Board of Directors because any member of the Board of Directors does not wish to continue in service or if the Board of Directors decides not to re-nominate a member for re-election, the Board of Directors would determine the desired skills and experience of a new nominee (including a review of the skills set forth above), may solicit suggestions for director candidates from all board members and may engage in other search activities.

The Board of Directors may consider qualified candidates for director suggested by our stockholders. Stockholders can suggest qualified candidates for director by writing to our Corporate Secretary at 19 Park Avenue, Rutherford, New Jersey 07070. The Board of Directors has adopted a procedure by which stockholders may recommend nominees to the Board of Directors. Stockholders who wish to recommend a nominee must write to Blue Foundry Bancorp’s Corporate Secretary and such communication must include:

A statement that the writer is a stockholder and is proposing a candidate for consideration by the Board of Directors;

The name and address of the stockholder as they appear on Blue Foundry Bancorp’s books, and of the beneficial owner, if any, on whose behalf the nomination is made;

The class or series and number of shares of Blue Foundry Bancorp’s capital stock that are owned beneficially or of record by such stockholder and such beneficial owner;

A description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder;

A representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the nominee named in the stockholder’s notice;

The name, age, personal and business address of the candidate and the principal occupation or employment of the candidate;

The candidate’s written consent to serve as a director;

A statement of the candidate’s business and educational experience and all other information relating to such person that would indicate such person’s qualification to serve on Blue Foundry Bancorp’s Board of Directors; and

Such other information regarding the candidate or the stockholder as would be required to be included in Blue Foundry Bancorp’s proxy statement pursuant to Securities and Exchange Commission Regulation 14A.

To be timely, the submission of a candidate for director by a stockholder must be received by the Corporate Secretary at least 120 days prior to the anniversary date of the proxy statement relating to the preceding year’s annual meeting of stockholders. If the date of the annual meeting is advanced more than 30 days prior to or delayed more than 60 days after the anniversary of the preceding year’s annual meeting, a stockholder’s submission of a candidate shall be timely if delivered or mailed to and received by the Corporate Secretary of Blue Foundry Bancorp no later than the 10th day following the day on which public disclosure (by press release issued through a nationally recognized news service, a document filed with the Securities and Exchange Commission, or on a website maintained by Blue Foundry Bancorp) of the date of the annual meeting is first made.

Submissions that are received and that satisfy the above requirements are forwarded to the Board of Directors for further review and consideration, using the same criteria to evaluate the candidate as it uses for evaluating other candidates that it considers.

There is a difference between the recommendations of nominees by stockholders pursuant to this policy and a formal nomination (whether by proxy solicitation or in person at a meeting) by a stockholder. Stockholders have certain rights under applicable law with respect to nominations, and any such nominations must comply with applicable law and provisions of the Bylaws of Blue Foundry Bancorp. See “Stockholder Proposals and Nominations.”

| | | | | | | | | | Blue Foundry Bancorp | 2022 Proxy Statement

| | 19

|

| | | Proposal I: Election of Directors | | |

AUDIT COMMITTEE REPORT

The Audit Committee has issued a report that states as follows:

We have reviewed and discussed with management our audited consolidated financial statements for the year ended December 31, 2021.

We have discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board Auditing Standard.

We have received the written disclosures and the letter from the independent registered public accounting firm required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence,” and have discussed with the independent registered public accounting firm their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, excepta person or entity is deemed to be the extent thatbeneficial owner, for purposes of this table, of any shares of Blue Foundry Bancorp specifically incorporates this informationcommon stock if they have shared voting or investment power with respect to such common stock or has a right to acquire beneficial ownership at any time within 60 days from March 21, 2023. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct and the named individuals and group exercise sole voting and investment power over the shares of Blue Foundry Bancorp common stock.

|

| (2) | Based on a total of 27,707,019 shares of common stock outstanding as of March 21, 2023. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 10 |

Proxy Statement | (3) | As disclosed in Schedule 13G filed with the SEC on February 10, 2023. |

| (4) | As disclosed in Schedule 13G filed with the SEC on February 9, 2023. |

| (5) | As disclosed in Schedule 13G filed with the SEC on February 1, 2023. |

| (6) | As disclosed in Schedule 13G filed with the SEC on February 13, 2023. |

| (7) | Includes 34,882 shares held in an individual retirement account, 8,500 shares held in our 401(k) Plan, 4,320 shares allocated under the Blue Foundry Bank’s ESOP, 114,090 unvested restricted stock awards and 114,090 unvested performance awards. |

| (8) | Includes 8,202 shares held in individual retirement accounts. |

| (9) | Includes 10,366 shares held in an individual retirement account. |

| (10) | Includes 7,500 shares held in an individual retirement account and 27,887 shares held in a 401(k) Plan. |

| (11) | Includes 40,000 shares held in an individual retirement account. |

| (12) | Includes 14,238 shares held in an individual retirement account, 9,100 shares held by reference,his spouse’s individual retirement account and shall not otherwise be deemed filed116 shares held as custodian for his child. |

| (13) | Includes 1,500 shares held in an individual retirement account. |

| (14) | Includes 35,000 unvested restricted stock awards and 35,000 unvested performance awards. |

| (15) | Includes 17,500 shares held in our 401(k) Plan, 4,320 shares allocated under such Acts.the Blue Foundry Bank’s ESOP, 20,000 unvested restricted stock awards and 20,000 unvested performance awards. |

| (16) | Includes 20,000 unvested restricted stock awards and 20,000 unvested performance awards. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 11 |

| | | | |  | | Election of Directors | | |

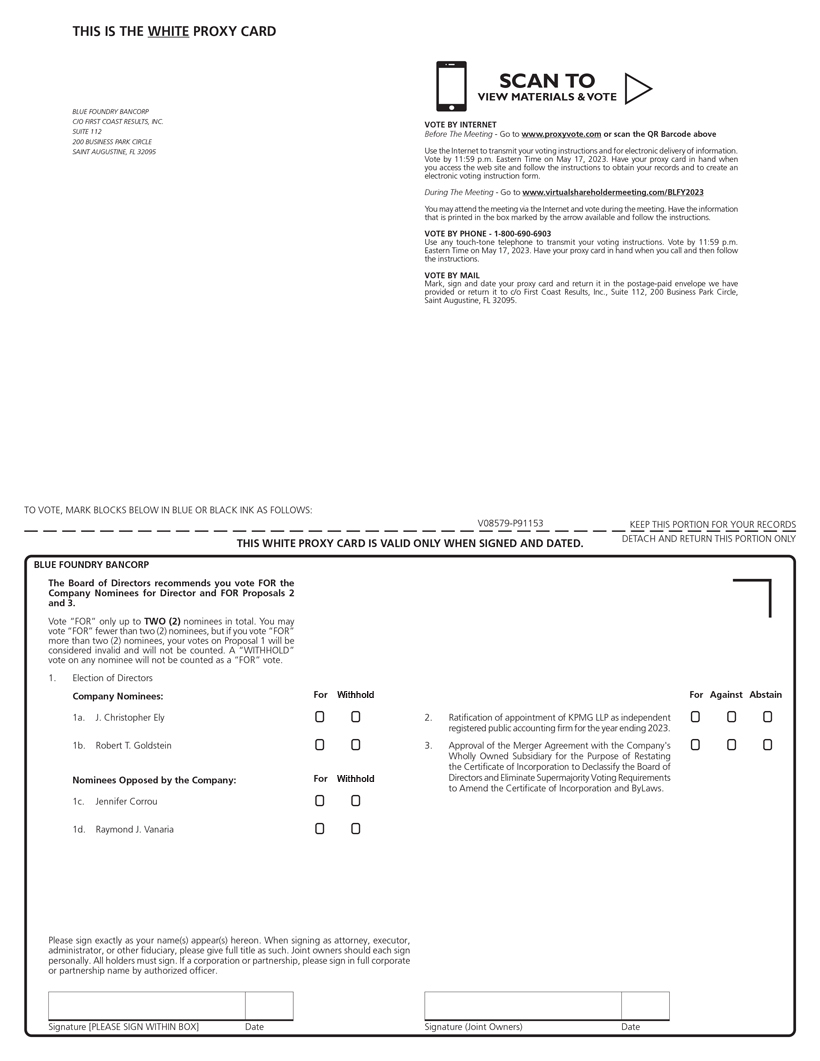

Our Board of Directors is comprised of nine members. Our Bylaws provide that directors are divided into three classes, with one class of directors elected annually. Two directors have been nominated for election at the annual meeting to serve for a three-year period and until their respective successors shall have been elected and qualified. The Board of Directors has nominated J. Christopher Ely and Robert T. Goldstein to serve as directors for three-year terms. Each nominee is currently an independent director of Blue Foundry Bancorp. The following sets forth certain information regarding the Board’s nominees, the other current members of our Board of Directors, and executive officers who are not directors, including the terms of office of board members. Shares represented by properly executed WHITE proxies will be voted in favor of these persons unless contrary instructions are provided. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve, if elected. Except as indicated herein, there are no arrangements or understandings between any nominee or continuing director and any other person pursuant to which such nominee or continuing director was selected. Age information is as of December 31, 2022, and term as a director includes service with Blue Foundry Bank. Your Board of Directors unanimously recommends that you vote FOR the election of J. Christopher Ely and Robert T. Goldstein, who are independent directors and the nominees of the Board. Your Board of Directors strongly opposes the Seidman Group’s proxy solicitation and urges you (A) not to vote for the Seidman Group nominees (Jennifer Corrou and Raymond J. Vanaria) on the enclosed WHITE universal proxy card, and (B) not sign or return any blue proxy card sent to you by the Seidman Group. Even voting to WITHHOLD a vote on the Seidman Group nominees by signing and returning the blue proxy card could invalidate any vote a shareholder may want to make FOR the nominees recommended by your Board. Shareholders wanting to support the nominees recommended by the Board, J. Christopher Ely and Robert T. Goldstein, should sign and return the WHITE proxy card. With respect to directors and nominees, the biographies contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Board of Directors to determine that the person should serve as a director. Each director of Blue Foundry Bancorp is also a director of Blue Foundry Bank. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 12 |

Proposal 1: Election of Directors DIRECTOR INFORMATION | | | | | | | | | | | | | | | | | | | | | | | | | | NESCI | | KINZLER | | LANG | | ELY | | GOLDSTEIN | | GRIMBILAS | | SHAW | | LETSCHE | | JOBES | Demographics | | | | | | | | | | | | | | | | | | | | | Age | | | | 50 | | 64 | | 44 | | 66 | | 60 | | 69 | | 57 | | 70 | | 56 | Gender | | | | M | | M | | F | | M | | M | | M | | M | | F | | F | Tenure (years) | | | | 4 | | 11 | | 3 | | 26 | | 8 | | 26 | | 13 | | 8 | | 0 | | | | | | | | | | | | | Skills | | Description | | | | | | | | | | | | | | | | | | | Finance & Accounting | | Experience in finance, accounting, or audit | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | Financial Services | | Experience in financial services, capital markets, investment banking | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | Innovation, Technology, and Cyber | | Experience with information technology, cyber security, or digital technology | | ✓ | | ✓ | | | | | | | | | | ✓ | | | | | Market Knowledge | | Knowledge of the markets we serve, including commercial real estate and small business | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | Executive Experience / Leadership | | Experience as an executive or leader of a public or private organization | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Risk | | Experience with risk management | | ✓ | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | | | ✓ | ESG Matters | | Experience with ESG matters | | ✓ | | | | ✓ | | | | | | | | ✓ | | | | ✓ | Legal, Regulatory, or Compliance | | Experience with legal, regulatory, or compliance related matters | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | Human Capital Management | | Experience with human resources matters including diversity, equity, and inclusion | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Philanthropic/ Charitable | | Community involvement or engagement with non-profit organizations | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ |

DIRECTORS The Board of Directors currently consists of nine (9) members and is divided into three classes, with one class of directors elected each year. The following table states our directors’ names, their ages as of December 31, 2022, the years when they began serving as directors of Blue Foundry Bank and the years when their current terms expire. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 13 |

Proposal 1: Election of Directors | | | | | | | | | | | | | | | | Name | | Position(s) Held With Blue Foundry Bancorp and Blue Foundry Bank | | Age | | | Director Since | | | Current Term Expires | | J. Christopher Ely | | Vice Chairman | | | 66 | | | | 1997 | | | | 2023 | | Robert T. Goldstein | | Director | | | 60 | | | | 2015 | | | | 2023 | | Kenneth Grimbilas | | Chairman of the Board | | | 69 | | | | 1997 | | | | 2024 | | Jonathan M. Shaw | | Director | | | 57 | | | | 2010 | | | | 2024 | | Margaret Letsche | | Director | | | 70 | | | | 2015 | | | | 2024 | | James D. Nesci | | President, Chief Executive Officer and Director | | | 50 | | | | 2019 | | | | 2025 | | Patrick H. Kinzler | | Director | | | 64 | | | | 2012 | | | | 2025 | | Mirella Lang | | Director | | | 44 | | | | 2020 | | | | 2025 | | Elizabeth Varki Jobes | | Director | | | 56 | | | | 2023 | | | | 2025 | |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 14 |

Proposal 1: Election of Directors The nominees for director are: | | | | | | J. Christopher Ely | | |

This report has been provided by the Audit Committee:AGE: 66

DIRECTOR SINCE: 1997 POSITION: Vice Chairman | | J. Christopher Ely (Chair)has been a Director of Blue Foundry Bank for over 25 years. Mr. Ely, a licensed real estate agent, is President of One Madison Management Corp., a real estate management and consulting firm that serves the needs of residential, commercial and industrial property owners in Northern New Jersey. He received a Bachelor of Science degree in Business Administration/Accounting from Montclair State College, began his career with Price Waterhouse and Co. and earned his Certified Public Accounting license. He serves as an Assistant Treasurer for the Glen Ridge Congregational Church. Mr. Ely chairs the Audit Committees of both the Company and Blue Foundry Bank. | | Mr. Ely provides the Board of Directors with extensive knowledge of accounting, real estate and small business management matters. |

| | | | | | Robert T. Goldstein | | |

AGE: 60 DIRECTOR SINCE: 2015 POSITION: Director | | Robert T. Goldstein currently serves as Director of Business Development at Astorino Financial Group, Inc. having previously been an Investment Advisory Representative at the firm. Prior to those positions, he was the President and Owner of R.J. Goldstein & Associates, Inc., an employee benefits consulting and brokerage firm, which he sold to World Insurance Associates, LLC (WIA) in 2017. He remains a Principal at WIA. Mr. Goldstein received his Bachelor of Science in Mathematics from Fairfield University. He also has received his Fellowship certificate from the National Association of Corporate Directors. | | Mr. Goldstein offers a valuable perspective and experience with respect to human capital and employee benefits matters as well as with respect to developing a successful business. |

| | |  | | OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE COMPANY’S SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE COMPANY’S NOMINEES FOR DIRECTOR. |

The following directors have terms ending at the 2024 Annual Meeting of Shareholders: | | | | | | Kenneth Grimbilas | | |

AGE: 69 DIRECTOR SINCE: 1997 POSITION: Chairman of the Board | | Kenneth Grimbilas is the Chairman of Blue Foundry Bank Board of Directors and has served as a Director for over 20 years. Mr. Grimbilas is the Chief Executive Officer of Tornqvist, Inc., a boutique fabrication and machine shop that has served many clients in the pharmaceuticals, government, transportation, aerospace, entertainment, and consumer goods industries. In addition, Mr. Grimbilas has been a member of the board of the Chilton Memorial Hospital Foundation, now Chilton Medical Center, part of Atlantic Health. | | Mr. Grimbilas’ success in developing and sustaining a manufacturing business in New Jersey provides the Board of Directors with knowledge of business and operational matters as well as the Northeastern New Jersey market area. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 15 |

Proposal 1: Election of Directors | | | | | | Margaret Letsche | | |

AGE: 70 DIRECTOR SINCE: 2015 POSITION: Director | | Margaret Letsche is retired from her position as the Executive Director of 55 Kip Center, a non-profit community center for older adults. Ms. Letsche earned an Associate Degree in Business Management from Morris County Community College and a Bachelor’s degree in Psychology from Felician College. She holds professional certifications from Rutgers in Continued Education and Professional Development. She also has received her Fellowship certificate from the National Association of Corporate Directors. Ms. Letsche is a current Board Member on the Rutherford | | Community Blood Bank and has previously served on the Borough of Rutherford Zoning Board and the Municipal Alliance Committee. Ms. Letsche’s experience in our community provides valuable insight into the economic and business needs of our community, as well as insight into where we can best serve our community in other ways, including charitable donations. |

| | | | | | Jonathan M. Shaw | | |

AGE: 57 DIRECTOR SINCE: 2010 POSITION: Director | | Jonathan M. Shaw is President and Owner of Salon Development Corp, a regional chain of hair salons founded in 1964, and President and Owner of Lemon Tree Development, the national franchisor of Lemon Tree Hair Salons. Mr. Shaw received a Bachelor of Science from Syracuse University. He also has received his NACD Fellowship certificate. | | Mr. Shaw’s experience as a business owner and entrepreneur offers a valuable perspective on developing a successful business as well as the challenges and risks an organization may face as it grows its product offerings and markets into new areas. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 16 |

Proposal 1: Election of Directors The following directors have terms ending at the 2025 Annual Meeting of Shareholders: | | | | | | James D. Nesci | | |

AGE: 50 DIRECTOR SINCE: 2019 POSITION: President, Chief Executive Officer and Director | | James D. Nesciserves as President and Chief Executive Officer of Blue Foundry Bank, a position he has held since 2018. In addition, he is a former board member of the New Jersey Bankers Association. Mr. Nesci has been instrumental in developing the Blue Foundry Bank brand. Prior to his role at Blue Foundry Bank, he served as Head of National Sales for TD Bank’s $20 billion U.S. wealth management business. Before joining TD Bank, Mr. Nesci served as Executive Vice President and Chief Wealth Management Officer of Provident Bank and was President of Beacon Trust, a wholly owned subsidiary of Provident Bank. Prior to this, Mr. Nesci was Chief Operating Officer with Wilmington Trust Company, National Wealth Management. Mr. Nesci earned two separate MBAs from Columbia Business School and the London Business School, respectively, as well as | | a Bachelors degree in Business Administration in Finance from Hofstra University in New York. He also has received his NACD Fellowship certificate. Mr. Nesci’s positions as President and Chief Executive Officer foster clear accountability, effective decision-making, a clear and direct channel of communication from senior management to the full Board of Directors, and alignment on corporate strategy. |

| | | | | | Patrick H. Kinzler | | |

AGE: 64 DIRECTOR SINCE: 2012 POSITION: Director | | Patrick H. Kinzler has been Managing Principal at HLW International LLP, an architectural firm, since 2006. His areas of responsibility include Finance, Legal, and Information Technology. Mr. Kinzler served as Treasurer of KPMG Consulting / BearingPoint from January 2000 until December 2005. From 1997 until 2000, Mr. Kinzler served as Assistant Treasurer of SmithKline Beecham. Mr. Kinzler began his corporate career in 1986 with PNC Financial Corp., first in the credit training program and then as a Corporate Banker in PNC’s New York office. His last position was a Manager of Large Corporate Banking in the New Jersey marketplace. Mr. Kinzler received a Bachelors degree in Business Administration and Accounting from Shippensburg State University and an MBA in Finance from Temple University. | | Mr. Kinzler’s valuable experience in banking and corporate treasury greatly assists the Board of Directors with its assessment of our risk management efforts and operational needs. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 17 |

Proposal 1: Election of Directors | | | | | | Mirella Lang | | | | |

AGE: 44 DIRECTOR SINCE: 2020 POSITION: Director | | Mirella Lang is Managing Director of AQR’s Business Development team, representing the firm’s investment strategies to institutional investors throughout the United States. Prior to AQR, Ms. Lang was a Director in the Financial Institutions Group in the investment banking division at UBS, and earlier at Merrill Lynch & Co. While in investment banking, Ms. Lang advised banks, asset management and insurance companies on corporate initiatives, such as M&A, capital raising, restructuring, and leveraged buyouts. She earned a Bachelor of Science in Accounting from Washington & Lee University and received an MBA from the University of California at Berkeley’s Haas School of Business. | | Ms. Lang serves on the Board of ASSIST, a non-profit organization focused on high school exchange education for exceptionally gifted international students. Ms. Lang’s experience with investment management, investment banking and the financial institutions industry brings valuable skills to our board. | | | | Elizabeth Varki Jobes, Esq. | | |

AGE: 56 DIRECTOR SINCE: 2023 POSITION: Director | | Elizabeth Varki Jobes, Esq. serves as Senior Vice President and Global Chief Compliance Officer of Amryt Pharmaceuticals, a global commercial-stage pharmaceutical company, since 2020. Before joining Amryt, Ms. Jobes served as Senior Vice President and Chief Compliance Officer of North America at EMD Serono. Ms. Jobes also served in leadership roles at Spark Therapeutics, Auxilium Pharmaceutical, and Cephalon. Prior to her career in the pharmaceuticals industry, Jobes held various roles within Philadelphia’s District Attorney’s Office from 1991 to 2006. Ms. Jobes’ service on several boards demonstrates her invaluable leadership skills. She currently serves on the board of Ampio Pharmaceuticals, a public | | company, as well as the board of a private biopharmaceutical company (Eyam Vaccines and Immunotherapeutics), and the board of a not-for-profit organization. Ms. Jobes is a member of the South Asian Bar Association and was a former board member of Women’s Way. She received her law degree from Rutgers University School of Law and is licensed to practice in both New Jersey and Pennsylvania. Ms. Jobes’ years of combined legal and compliance experience leading large, global companies, as well as her service on a public board, brings additional perspective to our board. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 18 |

Proposal 1: Election of Directors The Seidman Group has provided the Company notice that it is nominating two persons for election as directors at the annual meeting. As a result, the election of directors is considered a contested election, meaning the two nominees receiving the largest pluralities of the votes cast will be elected. The Board of Directors unanimously recommends that you disregard any blue proxy card that may be sent to you by the Seidman Group. Voting to WITHHOLD with respect to the Seidman Group’s nominees (Jennifer Corrou and Raymond J. Vanaria), on their blue proxy card is not the same as voting FOR the Company’s Board of Director nominees, J. Christopher Ely and Robert T. Goldstein, because a vote to WITHHOLD with respect to the Seidman Group’s nominees on their blue proxy card will revoke any previous proxy submitted by you. If you have already voted using a blue proxy card sent to you by the Seidman Group, you can revoke it by following the instructions on the WHITE proxy card to vote via the Internet or by telephone or by signing, dating and returning the enclosed WHITE proxy card. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the annual meeting. For example, this means that if you have submitted a WHITE proxy voting FOR the nominees recommended by your Board but later submit a blue proxy card withholding your votes from the Seidman Group nominees, your prior vote in favor of J. Christopher Ely and Robert T. Goldstein, the nominees recommended by your Board, will not be counted. Although the Company is required to include all nominees for election on its universal WHITE proxy card, for additional information regarding the Seidman Group’s nominees and related information, please refer to the Seidman Group’s proxy statement. Even if you would like to elect the nominees of the Seidman Group, we strongly recommend you use the Company’s WHITE proxy card to do so. Shareholders will be able to obtain, free of charge, copies of all proxy statements, any amendments or supplements thereto and any other documents (including the universal WHITE proxy card) when filed by the applicable party with the SEC in connection with the annual meeting at the SEC’s website (http://www.sec.gov). EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS Kelly Pecoraro, age 54, has been our Executive Vice President and Chief Financial Officer since May 2022. Prior to joining Blue Foundry Bank, Ms. Pecoraro served as Executive Vice President, Chief Accounting Officer and Comptroller from January 2019 until April 2022 at Investors Bank, Short Hills, New Jersey, when Investors Bank was acquired by Citizens Financial Group, Inc. Ms. Pecoraro joined Investors Bank in May 2005 as part of the Financial Reporting team, holding various positions prior to becoming the Chief Accounting Officer in January 2010. Prior to joining Investors Bank, Ms. Pecoraro served as an audit professional at KPMG LLP. Ms. Pecoraro received a Bachelor’s degree in Accounting from St. Peter’s College and is a Certified Public Accountant. Jason Goldberg, age 48, has been our Executive Vice President and Chief Lending Officer since September 2021. Prior to joining Blue Foundry Bank, Mr. Goldberg held a senior vice president position at Israel Discount Bank of New York where he worked from October 2015 to September 2021. Prior to that, Mr. Goldberg held a senior vice president position at Crestmark Bank where he worked from October 2010 to September 2015, and was vice president at Westgate Financial Corporation from 2001 to 2010. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 19 |

Proposal 1: Election of Directors Elizabeth Miller, age 63, has been our Executive Vice President and Chief Retail Officer since October 2018. Prior to joining Blue Foundry Bank, Ms. Miller held positions at Affinity Federal Credit Union, the largest Credit Union in New Jersey, where she was the Senior Vice President of Member Experience and Service from October 2014 to October 2018 and led the multi-state branch network, the wealth and business development teams, the central operations group and the 65-person call center. Prior to that, Ms. Miller worked at Peapack Gladstone Bank from August 2011 to October 2014, where she was the Vice President of Retail Branch Sales and Operations. Ms. Miller has a Bachelor’s degree in Business and Marketing from Montclair State University. Elyse D. Beidner, age 69, has been our Executive Vice President and Chief Legal Officer since 2004. Prior to joining Blue Foundry Bank, Ms. Beidner had gained more than 25 years of experience providing legal support for various financial institutions including JP Morgan Chase and Bank of America. She earned her Bachelor’s degree in French and Spanish from Goucher College, her Juris Doctor degree from Widener University School of Law, and her Masters in Corporate Law from New York University School of Law. Alex Malkiman, age 48, has been our Executive Vice President and Chief Technology Officer since March 2022. Prior to joining Blue Foundry Bank, Mr. Malkiman acted as the Executive Director and Head of IT Infrastructure and Security at CIFC Asset Management and as Director of Global Infrastructure and Client Services at ITG. Mr. Malkiman earned a Bachelor of Science in Computer and Information Science from Brooklyn College, and later went on to earn a MBA in Information Systems Management and Financial Management from the Lubin School of Business a Pace University. Thomas Packwood, age 57, has been our Senior Vice President and Chief Audit Executive since 2011. Prior to joining Blue Foundry Bank, Mr. Packwood held senior positions at Deloitte, U.S.B. Holding Co., USA Bank, and RSM US LLP. Mr. Packwood received a Bachelor’s degree in Accounting from Villanova University and is a Certified Public Accountant. Additionally, he invented and implemented a patented quarterly Risk Assessment and Management System. Acela Roselle, age 62, has been our Executive Vice President and Human Resources Director since 1999. Prior to joining Blue Foundry Bank, Ms. Roselle acted as the Employment Manager at Meadowlands Hospital Medical Center. Ms. Roselle attended The Wood Business School in New York and obtained a SHRM PHR Certification through Fairleigh Dickinson University in 2000. Robert Rowe, age 61, has been our Executive Vice President and Chief Risk Officer since November 2022. Prior to joining Blue Foundry Bank, Mr. Rowe served as Executive Vice President and Chief Credit Officer of Webster Financial Corporation, and as Executive Vice President and Chief Credit Officer of Sterling National Bank from July 2019 until Sterling’s merger with Webster Bank in 2022. Prior to that, Mr. Rowe was Chief Credit Officer and subsequently Chief Risk Officer at CIT Group Inc. from 2010 through 2018. Prior to joining CIT Group, Mr. Rowe served as Chief Credit Officer at National City Corporation until its acquisition by PNC Corporation. Mr. Rowe received a Bachelor’s degree in Economics from Boston College and an MBA in Finance from Indiana University. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 20 |

Proposal 1: Election of Directors Environmental, Social and Governance (“ESG”) Matters SUMMARY We recognize and are committed to our corporate responsibility to conduct business in an environmentally sustainable and socially appropriate manner. We deeply care about the environment and the communities in which we operate and in that regard we carefully consider how we do business and who we do business with. We believe this commitment and focus supports long-term shareholder value. Blue Foundry Bancorp conducts its business activities with a view to ensuring that the interests of all stakeholders, including shareholders, employees, customers and communities, are considered. ESG matters are discussed at the Board’s Nominating and Corporate Governance Committee, the Bank’s Executive Leadership Committee meetings, and the recently formed management ESG Committee, where ideas and actions are generated and monitored. Blue Foundry Bank has traditionally prioritized a highly engaged and diverse employee base serving its communities and customers in a safe, prudent and risk disciplined manner. It has developed a robust enterprise risk management and compliance function, including cybersecurity and privacy policies. It maintains strong and proactive relationships with its regulators. We have focused initially on several key priorities as part of our ESG initiatives: Business ethics are of manifest importance to us. Every director and employee is expected to comply with the Code of Conduct and recertifies their compliance on an annual basis. Safeguarding the privacy of customer data has always and continues to be a significant focus. The Company makes ongoing investments in systems and technology, and we have implemented a strong, multi-layered perimeter to safeguard customer data. We regularly conduct tests to ensure that staff remains vigilant with respect to Company and customer information privacy. In addition, we regularly monitor the adequacy of our consumer financial protection measures. To combat cybersecurity threats, training and education is provided regularly to the Board as well as employees so that they remain aware of possible threats to Company and customer information privacy. Diversity of the Board is of paramount importance. The Nominating and Governance Committee continually assesses the diverse attributes (such as geographic, professional, ethnic/racial) of the existing Board and identifies opportunities for expanding its diversity. Board-level discussions remain a continuing agenda item. Blue Foundry Bank has traditionally prioritized a highly engaged and diverse employee base serving its communities and customers in a safe, prudent and risk disciplined manner. It has developed a robust enterprise risk management and compliance function, including cybersecurity and privacy policies. It maintains strong and proactive relationships with its regulators. Actions taken to date with a view toward being environmentally conscious include reducing the amount of paper utilized within Blue Foundry Bank by digitizing all documents enterprise-wide, minimizing reliance on printers through increased use of technology, and increasing recycling. The administrative headquarters were designed with a focus specifically geared toward ESG. For example, all lighting throughout the space is energy-efficient and designed to be illuminated only when workspaces and offices are occupied. Window coverings were designed to operate in a manner geared to efficiently manage energy usage. The Company’s and Blue Foundry Bank’s focus on ESG initiatives continues to be expanded and remains a priority for the Board and management. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 21 |

HUMAN CAPITAL MANAGEMENT The success of our business is highly dependent on our employees who are dedicated to our mission to inspire and enable the communities we serve to achieve financial stability and success. We seek to hire and retain well qualified employees to sustain and build on our culture of service and performance. Our selection and promotion processes are without bias and include the active recruitment of minorities and women. Blue Foundry Bank maintains a job posting and referral program as well as an Affirmative Action Program, and, in an effort to attract and retain qualified applicants, particularly in areas where a shortage of personnel exists, Blue Foundry Bank provides additional incentives to employees who assist in the recruitment of new hires. Our workforce is 64% female and 36% male. None of our employees are covered by a collective bargaining agreement. We encourage the growth and development of our employees and, whenever possible, seek to fill positions by promotion and transfer from within the Company. Continual learning and career development are advanced through annual performance and development conversations between employees and their managers. Blue Foundry Bank encourages all employees to utilize internally developed training programs, customized corporate training engagements and educational reimbursement programs to improve their skills and qualifications to enable them to be considered for promotion or advancement. We offer employees an in-house leadership program, led by Rutgers University instructors, that includes critical thinking, emotional intelligence, management and leadership skills. The safety, health, and physical and mental wellness of our employees is a top priority. We promote the health and wellness of our employees by strongly encouraging work-life balance, offering flexible work schedules, keeping the employee portion of health care premiums to a minimum, and sponsoring various wellness programs through which employees are encouraged to incorporate healthy habits into their daily routines. The administrative office space was designed with the health and well-being of our workforce in mind in that it was configured to maximize natural light, provide flexible and collaborative workstations, as well as access to meditation rooms, a fitness center, and private space for nursing mothers. Employee retention is important to our continued success and helps us operate efficiently and achieve our business objectives. We provide competitive wages, annual incentive bonuses, a 401(k) Plan with an employer matching contribution, equity ownership in our Company via an employee stock ownership plan and equity incentive plan, healthcare and wellness programs, a life assistance program, flexible spending accounts, group term life insurance, identity fraud coverage, generous paid time off, 11 paid holidays, and an educational assistance program. At December 31, 2022, nearly 20% of our team had been with us for 10 years or more. DIVERSITY, INCLUSION AND RESPECT IN THE WORKPLACE Women in Banking at Blue Foundry

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 22 |

Proposal 1: Election of Directors Management and staff at all levels of the Company and Blue Foundry Bank are expected to behave in a fair, ethical and legal manner in all circumstances. This includes both internal interactions with other members of the organization and external interactions with customers, members of the community, vendors, and applicants for employment. We firmly believe that our high standard of ethical behavior will maintain the favorable reputation of Blue Foundry Bank in the marketplace and ensure Blue Foundry Bank remains a great place to work, invest in and do business with. We communicate our expectations for honest, fair and ethical behavior through numerous policies within the organization. The commitment of our directors and executive management team to moral and ethical behavior means that the proper tone is set from the top of the organization. This begins with our Code of Conduct which describes the moral, ethical, legal and regulatory requirements by which all personnel must conduct themselves. The Code of Conduct establishes the expectation that employees conduct themselves with integrity, at all times. It provides employees with governing principles to guide their conduct with clients, customers, suppliers, vendors, shareholders, co-workers, regulators, markets, and the communities in which we operate. It applies to the employees and directors of the Company, Blue Foundry Bank, and their direct and indirect subsidiaries. Importantly, each officer at the Vice President level and above, and each director must also abide by the Conflict of Interest and Confidentiality Policy. This Policy recognizes the importance of fostering a culture of transparency, integrity and honesty and, as such, mandates that all such parties avoid any actions that appear to interfere with good judgment concerning Blue Foundry Bank’s best interests. Blue Foundry Bank is dedicated to ensuring that all personnel decisions are in accordance with equal employment opportunity. We adhere to the principle that equal employment opportunity is not only a legal principle, it is a moral commitment as well. Our policy for Equal Employment and Affirmative Action states that Blue Foundry Bank will recruit, hire, train and promote, in all job classifications without regard to any classification protected by applicable federal, state or municipal law. It is the policy of Blue Foundry Bank that there shall be no discrimination with respect to employment, or any of the terms and conditions of employment, because of an individual’s race, color, sex, pregnancy or breastfeeding, sexual or affectional orientation, gender identity or expression, religion, creed, national origin, nationality or ancestry, citizenship, age, atypical hereditary cellular or blood trait, genetic information, disability (including AIDS and HIV infection), marital status, civil union status, domestic partnership status, veteran status, refusal to submit to a genetic test or to make available the results of a genetic test to an employer, or liability for service in the armed forces, or any other characteristic protected under applicable federal, state or local law. This policy applies to all employment actions including, but not limited to, recruitment, selection, training, promotion, transfer, layoff and termination, job-related social or recreational programs. Blue Foundry Bank’s policy statement is required to be displayed in an area which is readily accessible to both employees and applicants. Blue Foundry Bank maintains all facilities in such a manner that illegal segregation on the basis of any protected characteristic does not result. Our Anti-Harassment Policy states that Blue Foundry Bank is unequivocally opposed to and will not tolerate any harassment of a sexual, racial, ethnic, age or religious nature, or based on any other personal characteristics protected by law from such harassment, that is directed toward any employee or applicant for employment or any other person in the workplace by any other employee or person in the workplace. Blue Foundry Bank will not permit any employee to harass others with whom they have business interactions, including but not limited to other employees, customers and vendors, nor will it permit any outsider to harass Bank employees. This is true not only in the workplace, but during any event outside work involving Bank employees. All employees and supervisors must comply with this policy and take appropriate measures to ensure that such conduct does not occur. Additional policies that communicate the importance and expectations of honest, ethical and fair behavior include the Insider Trading Policy which prohibits directors, officers and other employees from trading shares of the Company’s common stock based on material nonpublic information. To reinforce the importance of the policies above, annual training programs on certain policies are provided to all employees. These programs help employees understand how the policies apply on a day-to-day basis and how to deal with events and situations that may occur. Employees are encouraged to report concerns without fear of retaliation and may do so in a confidential manner. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 23 |

The Company’s diversity is demonstrated throughout the organization, including by the members of the Executive Management team. Of our nine executives, four are women, one of whom is a member of an underrepresented minority group. Overall, Blue Foundry Bank’s staff is 64% female and 36% male. In keeping with the Board’s commitment to further diversify, the Board recently appointed Elizabeth Jobes resulting in a board that currently includes three women, one of whom is a member of an underrepresented minority group. The Board has made it a continuing priority to further expand its diversity. Community Engagement. A key element of our mission is to encourage the stability and success of our communities. The Company continues to support organizations that provide healthcare, economic assistance, education and other vital resources. Some of our more significant community-oriented efforts included support of food pantries across all of our markets, local law enforcement and emergency squads. We also continue to support our communities through the many donations made by the Blue Foundry Charitable Foundation. Further information related to Blue Foundry Bank’s support of its communities through volunteerism and philanthropic activities can be found in the ‘In the News’ section of Blue Foundry Bank’s website. Kenneth Grimbilas | | | 99,848 | (11) | | | * | | Patrick H. KinzlerJonathan M. Shaw

| | | 68,362 | (12) | | | * | | Mirella LangMargaret Letsche

| | | 66,477 | (13) | | | * | | TRANSACTIONS WITH CERTAIN RELATED PERSONSElizabeth Jobes

| | | — | | | | * | | The Sarbanes-OxleyExecutive Officers who are not Directors

| | | | | | | | | Kelly Pecoraro | | | 75,000 | (14) | | | * | | Elizabeth Miller | | | 68,621 | (15) | | | * | | Jason Goldberg | | | 40,000 | (16) | | | * | | All directors and executive officers as a group (17 persons) | | | | | | | 4.16 | % |

| (1) | In accordance with Rule 13d-3 under the Securities Exchange Act of 2002 generally prohibits publicly traded companies1934, as amended, a person or entity is deemed to be the beneficial owner, for purposes of this table, of any shares of Blue Foundry Bancorp common stock if they have shared voting or investment power with respect to such common stock or has a right to acquire beneficial ownership at any time within 60 days from making loansMarch 21, 2023. As used herein, “voting power” is the power to their executive officersvote or direct the voting of shares and directors, but it contains“investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct and the named individuals and group exercise sole voting and investment power over the shares of Blue Foundry Bancorp common stock. |

| (2) | Based on a specific exemption from such prohibitiontotal of 27,707,019 shares of common stock outstanding as of March 21, 2023. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 10 |

Proxy Statement | (3) | As disclosed in Schedule 13G filed with the SEC on February 10, 2023. |

| (4) | As disclosed in Schedule 13G filed with the SEC on February 9, 2023. |

| (5) | As disclosed in Schedule 13G filed with the SEC on February 1, 2023. |

| (6) | As disclosed in Schedule 13G filed with the SEC on February 13, 2023. |

| (7) | Includes 34,882 shares held in an individual retirement account, 8,500 shares held in our 401(k) Plan, 4,320 shares allocated under the Blue Foundry Bank’s ESOP, 114,090 unvested restricted stock awards and 114,090 unvested performance awards. |

| (8) | Includes 8,202 shares held in individual retirement accounts. |

| (9) | Includes 10,366 shares held in an individual retirement account. |

| (10) | Includes 7,500 shares held in an individual retirement account and 27,887 shares held in a 401(k) Plan. |

| (11) | Includes 40,000 shares held in an individual retirement account. |

| (12) | Includes 14,238 shares held in an individual retirement account, 9,100 shares held by his spouse’s individual retirement account and 116 shares held as custodian for loans made by federally insured financial institutions, suchhis child. |

| (13) | Includes 1,500 shares held in an individual retirement account. |

| (14) | Includes 35,000 unvested restricted stock awards and 35,000 unvested performance awards. |

| (15) | Includes 17,500 shares held in our 401(k) Plan, 4,320 shares allocated under the Blue Foundry Bank’s ESOP, 20,000 unvested restricted stock awards and 20,000 unvested performance awards. |

| (16) | Includes 20,000 unvested restricted stock awards and 20,000 unvested performance awards. |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 11 |

| | | | |  | | Election of Directors | | |

Our Board of Directors is comprised of nine members. Our Bylaws provide that directors are divided into three classes, with one class of directors elected annually. Two directors have been nominated for election at the annual meeting to serve for a three-year period and until their respective successors shall have been elected and qualified. The Board of Directors has nominated J. Christopher Ely and Robert T. Goldstein to serve as directors for three-year terms. Each nominee is currently an independent director of Blue Foundry Bancorp. The following sets forth certain information regarding the Board’s nominees, the other current members of our Board of Directors, and executive officers who are not directors, including the terms of office of board members. Shares represented by properly executed WHITE proxies will be voted in favor of these persons unless contrary instructions are provided. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve, if elected. Except as indicated herein, there are no arrangements or understandings between any nominee or continuing director and any other person pursuant to which such nominee or continuing director was selected. Age information is as of December 31, 2022, and term as a director includes service with Blue Foundry Bank. Your Board of Directors unanimously recommends that you vote FOR the election of J. Christopher Ely and Robert T. Goldstein, who are independent directors and the nominees of the Board. Your Board of Directors strongly opposes the Seidman Group’s proxy solicitation and urges you (A) not to vote for the Seidman Group nominees (Jennifer Corrou and Raymond J. Vanaria) on the enclosed WHITE universal proxy card, and (B) not sign or return any blue proxy card sent to you by the Seidman Group. Even voting to WITHHOLD a vote on the Seidman Group nominees by signing and returning the blue proxy card could invalidate any vote a shareholder may want to make FOR the nominees recommended by your Board. Shareholders wanting to support the nominees recommended by the Board, J. Christopher Ely and Robert T. Goldstein, should sign and return the WHITE proxy card. With respect to directors and nominees, the biographies contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Board of Directors to determine that the person should serve as a director. Each director of Blue Foundry Bancorp is also a director of Blue Foundry Bank. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 12 |

Proposal 1: Election of Directors DIRECTOR INFORMATION | | | | | | | | | | | | | | | | | | | | | | | | | | NESCI | | KINZLER | | LANG | | ELY | | GOLDSTEIN | | GRIMBILAS | | SHAW | | LETSCHE | | JOBES | Demographics | | | | | | | | | | | | | | | | | | | | | Age | | | | 50 | | 64 | | 44 | | 66 | | 60 | | 69 | | 57 | | 70 | | 56 | Gender | | | | M | | M | | F | | M | | M | | M | | M | | F | | F | Tenure (years) | | | | 4 | | 11 | | 3 | | 26 | | 8 | | 26 | | 13 | | 8 | | 0 | | | | | | | | | | | | | Skills | | Description | | | | | | | | | | | | | | | | | | | Finance & Accounting | | Experience in finance, accounting, or audit | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | Financial Services | | Experience in financial services, capital markets, investment banking | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | Innovation, Technology, and Cyber | | Experience with information technology, cyber security, or digital technology | | ✓ | | ✓ | | | | | | | | | | ✓ | | | | | Market Knowledge | | Knowledge of the markets we serve, including commercial real estate and small business | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | Executive Experience / Leadership | | Experience as an executive or leader of a public or private organization | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Risk | | Experience with risk management | | ✓ | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | | | ✓ | ESG Matters | | Experience with ESG matters | | ✓ | | | | ✓ | | | | | | | | ✓ | | | | ✓ | Legal, Regulatory, or Compliance | | Experience with legal, regulatory, or compliance related matters | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | Human Capital Management | | Experience with human resources matters including diversity, equity, and inclusion | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Philanthropic/ Charitable | | Community involvement or engagement with non-profit organizations | | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ |

DIRECTORS The Board of Directors currently consists of nine (9) members and is divided into three classes, with one class of directors elected each year. The following table states our directors’ names, their ages as of December 31, 2022, the years when they began serving as directors of Blue Foundry Bank and the years when their current terms expire. | | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 13 |

Proposal 1: Election of Directors | | | | | | | | | | | | | | | | Name | | Position(s) Held With Blue Foundry Bancorp and Blue Foundry Bank | | Age | | | Director Since | | | Current Term Expires | | J. Christopher Ely | | Vice Chairman | | | 66 | | | | 1997 | | | | 2023 | | Robert T. Goldstein | | Director | | | 60 | | | | 2015 | | | | 2023 | | Kenneth Grimbilas | | Chairman of the Board | | | 69 | | | | 1997 | | | | 2024 | | Jonathan M. Shaw | | Director | | | 57 | | | | 2010 | | | | 2024 | | Margaret Letsche | | Director | | | 70 | | | | 2015 | | | | 2024 | | James D. Nesci | | President, Chief Executive Officer and Director | | | 50 | | | | 2019 | | | | 2025 | | Patrick H. Kinzler | | Director | | | 64 | | | | 2012 | | | | 2025 | | Mirella Lang | | Director | | | 44 | | | | 2020 | | | | 2025 | | Elizabeth Varki Jobes | | Director | | | 56 | | | | 2023 | | | | 2025 | |

| | | | Blue Foundry Bancorp | 2023 Proxy Statement | | 14 |

Proposal 1: Election of Directors The nominees for director are: | | | | | | J. Christopher Ely | | |

AGE: 66 DIRECTOR SINCE: 1997 POSITION: Vice Chairman | | J. Christopher Ely has been a Director of Blue Foundry Bank to their executive officersfor over 25 years. Mr. Ely, a licensed real estate agent, is President of One Madison Management Corp., a real estate management and directorsconsulting firm that serves the needs of residential, commercial and industrial property owners in complianceNorthern New Jersey. He received a Bachelor of Science degree in Business Administration/Accounting from Montclair State College, began his career with federal banking regulations. Federal regulations permit executive officersPrice Waterhouse and directors to receiveCo. and earned his Certified Public Accounting license. He serves as an Assistant Treasurer for the same terms that are widely available to other employees as long asGlen Ridge Congregational Church. Mr. Ely chairs the director or executive officer is not given preferential treatment compared to the other participating employees. All transactions betweenAudit Committees of both the Company and its executive officers, directors, holdersBlue Foundry Bank. | | Mr. Ely provides the Board of 10% or moreDirectors with extensive knowledge of accounting, real estate and small business management matters. |

| | | | | | Robert T. Goldstein | | |

AGE: 60 DIRECTOR SINCE: 2015 POSITION: Director | | Robert T. Goldstein currently serves as Director of Business Development at Astorino Financial Group, Inc. having previously been an Investment Advisory Representative at the firm. Prior to those positions, he was the President and Owner of R.J. Goldstein & Associates, Inc., an employee benefits consulting and brokerage firm, which he sold to World Insurance Associates, LLC (WIA) in 2017. He remains a Principal at WIA. Mr. Goldstein received his Bachelor of Science in Mathematics from Fairfield University. He also has received his Fellowship certificate from the National Association of Corporate Directors. | | Mr. Goldstein offers a valuable perspective and experience with respect to human capital and employee benefits matters as well as with respect to developing a successful business. |

| | |  | | OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE COMPANY’S SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE COMPANY’S NOMINEES FOR DIRECTOR. |

The following directors have terms ending at the 2024 Annual Meeting of Shareholders: | | | | | | Kenneth Grimbilas | | |

AGE: 69 DIRECTOR SINCE: 1997 POSITION: Chairman of the sharesBoard | | Kenneth Grimbilas is the Chairman of its common stock and affiliates thereof, are on terms no less favorable to the Company than could have been obtained by it in arms-length negotiations with unaffiliated persons. Such transactions must be approved by a majority of the independent directors of the Company not having any interest in the transaction. In the ordinary course of business, Blue Foundry Bank makes loans available to its directors, officersBoard of Directors and employees. The aggregate amounthas served as a Director for over 20 years. Mr. Grimbilas is the Chief Executive Officer of our outstanding loans to our executive officersTornqvist, Inc., a boutique fabrication and directorsmachine shop that has served many clients in the pharmaceuticals, government, transportation, aerospace, entertainment, and their related entities was approximately $54,000 at December 31, 2021, consisting of one loan to an officerconsumer goods industries. In addition, Mr. Grimbilas has been a member of the Company. This loan was madeboard of the Chilton Memorial Hospital Foundation, now Chilton Medical Center, part of Atlantic Health. | | Mr. Grimbilas’ success in developing and sustaining a manufacturing business in New Jersey provides the ordinary courseBoard of Directors with knowledge of business on substantiallyand operational matters as well as the same terms, including interest rate and collateral, as those prevailing at the time for comparable loans with persons not related to Northeastern New Jersey market area. |